Vergent LMS vs. Shaw Systems vs. Nortridge: Which Lending Platform Wins in 2025?

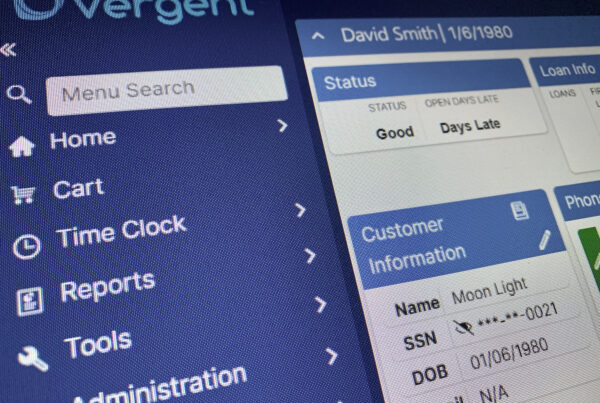

Introduction Choosing the right loan management system isn’t just about features—it’s about long-term impact. Your lending platform will influence everything from operations to borrower experience to bottom-line performance. With so…